45 what is the duration of a zero coupon bond

Zero Coupon Bond: Definition, Formula & Example - Video ... A zero coupon bond is one option for investors to consider. Learn the definition of zero coupon bonds, discover the formula used to calculate pricing, and check understanding with an example. Solved a. What is the duration of a zero-coupon bond that ... What is the duration of a zero-coupon bond that has five years to maturity? b. What is the duration if the maturity increases to 7 years? c. What is the duration if the maturity increases to 9 years? a. b. Who are the experts? Experts are tested by Chegg as specialists in their subject area.

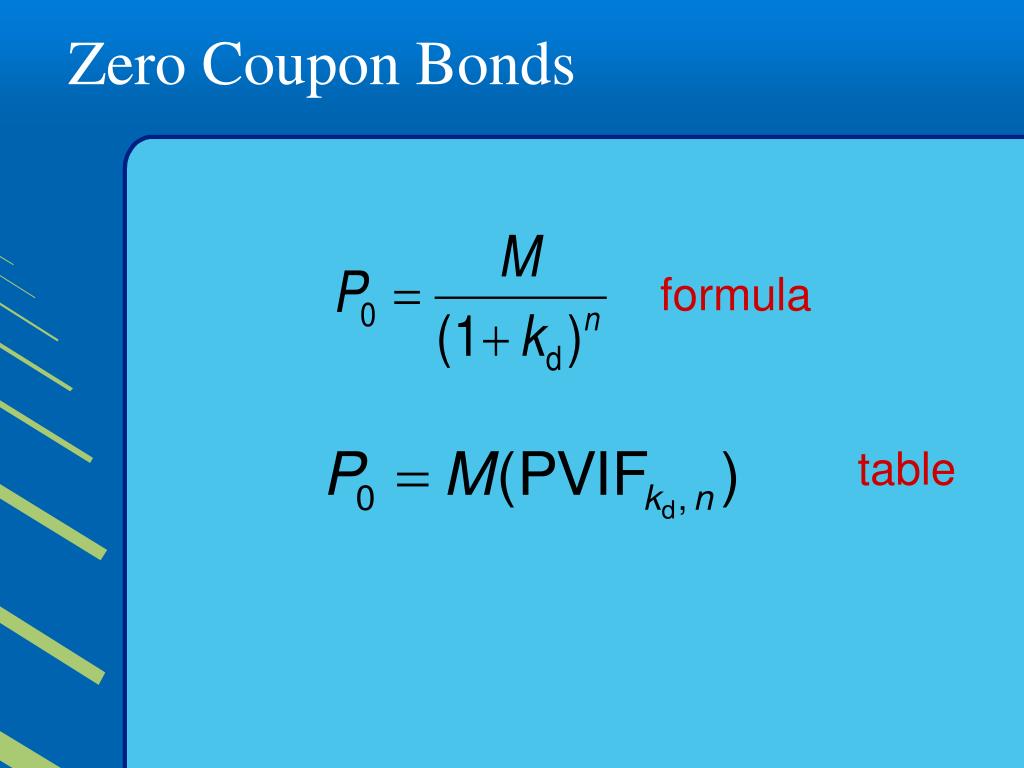

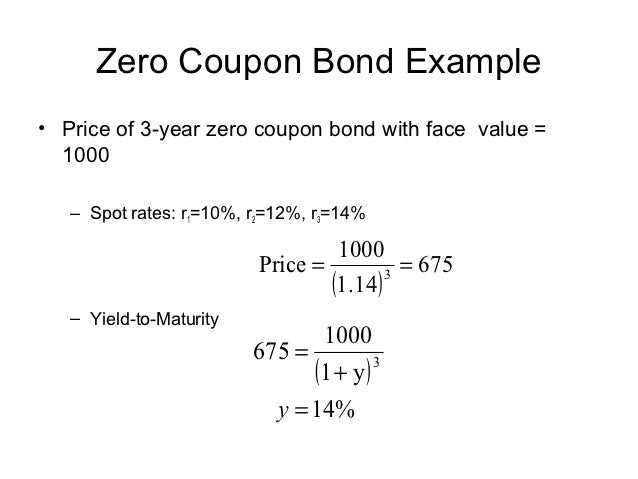

How to Calculate a Zero Coupon Bond Price | Double Entry ... n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond.

What is the duration of a zero coupon bond

Zero Coupon Bond (Definition, Formula, Examples, Calculations) is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. What is the duration of a zero-coupon bond that has eight ... The duration of a zero-coupon bond is by definition equal to its maturity, so an 8-year zero has a duration of 8 years. If the maturity increases to 10 years, then so does the duration. Sponsored by Money.com 10 Best Gold IRAs Reviewed. We reviewed the 10 best gold IRAs in the market. Trusted by over 45 million individuals in USA. Learn More Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

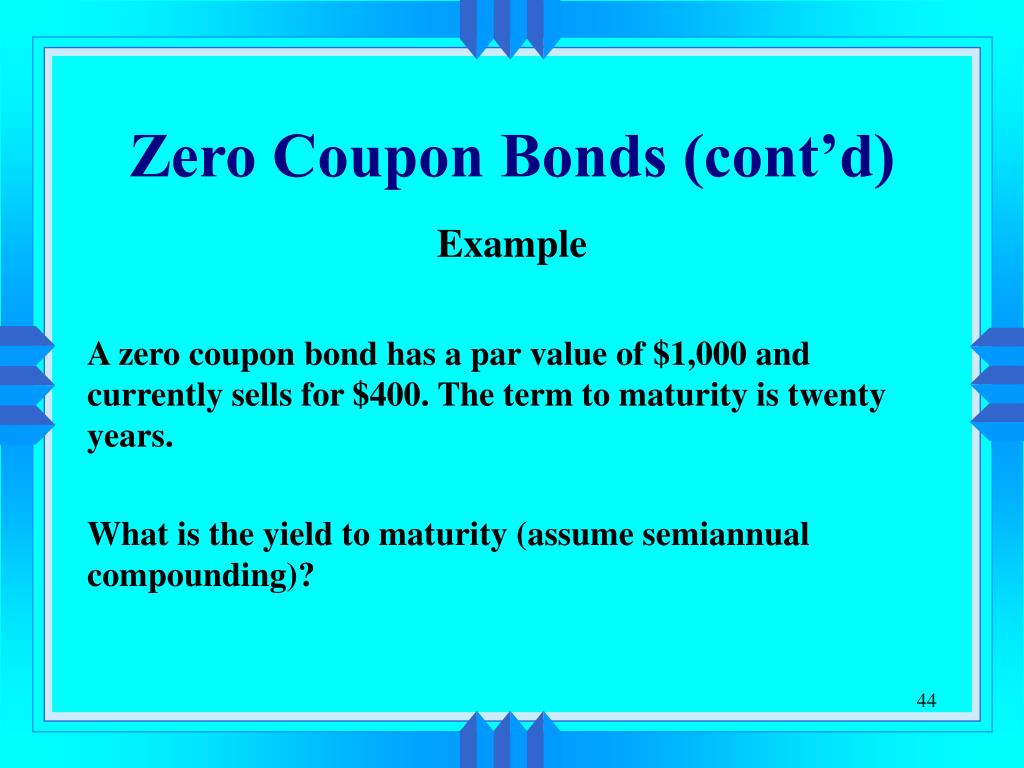

What is the duration of a zero coupon bond. What is the duration of a bond? and How to Calculate It? The duration of a bond represents the relationship between the price of a bond and interest rates. Generally, the relationship between the two is inverse, which means when interest rates are high, the price of the bond will fall and vice versa. The duration of a bond is different from its maturity as both present different time periods of a bond. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Zero Coupon bond is also named as accrual bond and it lacks the coupons or the installments procedure for making the payments; instead, a single payment at the level of maturity (the time period or the duration) is paid. The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and... Zero-Coupon Bonds: Pros and Cons Zero-Coupon Bonds: Pros and Cons. Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. fixed income - Duration of callable zero coupon bond - Quantitative ... A 10-year zero coupon bond is callable annually at par (its face value) starting at the beginning of year 6. Assume a flat yield curve of 10%. What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal ... Zero-Coupon Bond: Formula and Excel Calculator Generally, zero-coupon bonds have maturities of around 10+ years, which is why a substantial portion of the investor base has longer-term expected holding periods. Zero Coupon Bond -Features, benefits, drawbacks ... Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero coupon bonds are issued periodically by governments and pseudo-government institutions. Once these bonds are issued, they can be bought through stock exchanges such as NSE and BSE.

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ... Answered: You are managing a portfolio of £20… | bartleby Your target duration is 6 years, and you can choose from two bonds: a zero-coupon bond with 3 years of maturity and a perpetuity, each currently yielding 5%. Next year, the target duration is 5 years. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up to 52 weeks. are an example of a zero-coupon bond. Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!)

6) You purchased a zero-coupon bond one year ago for $276.83. The market interest rate is now 7 ...

What is the period of a zero coupon bond? | Personal ... Zero coupon bonds have a period equal to the bond's time to maturity, which makes them sensitive to any modifications within the rates of interest. Investment banks or dealers might separate coupons from the principal of coupon bonds, which is known as the residue, so that different buyers might obtain the principal and each of the coupon payments.

Zero Coupon Bond Price Calculate the price of a zero coupon bond that matures | Course Hero

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. ... Therefore, in case of longer time duration (a higher 'N'), it might prove to be profitable for the ...

Bond Duration Calculator - Exploring Finance Based on the above information, here are all the components needed in order to calculate the Macaulay Duration: m = Number of payments per period = 2 YTM = Yield to Maturity = 8% or 0.08 PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06

What Is a Zero-Coupon Bond? Definition, Characteristics ... Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond . Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

Solved a. What is the duration of a zero-coupon bond that - Chegg a. What is the duration of a zero-coupon bond that has eight years to maturity? b. What is the duration if the maturity increases to 10 years? c. What is the duration if the maturity increases to 12 years? a. Duration of the bond b. Duration of the bond c. Duration of the bond years years years.

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

What is the duration of a zero-coupon bond that has eight ... The duration of a zero-coupon bond is by definition equal to its maturity, so an 8-year zero has a duration of 8 years. If the maturity increases to 10 years, then so does the duration. Sponsored by Money.com 10 Best Gold IRAs Reviewed. We reviewed the 10 best gold IRAs in the market. Trusted by over 45 million individuals in USA. Learn More

Zero Coupon Bond (Definition, Formula, Examples, Calculations) is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest.

Post a Comment for "45 what is the duration of a zero coupon bond"