38 ytm for zero coupon bond

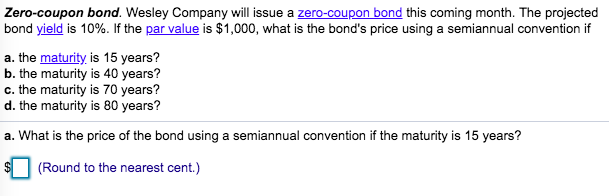

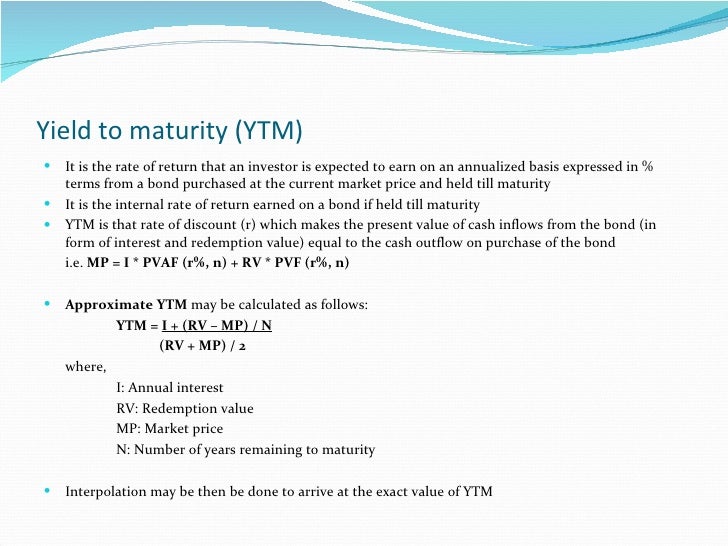

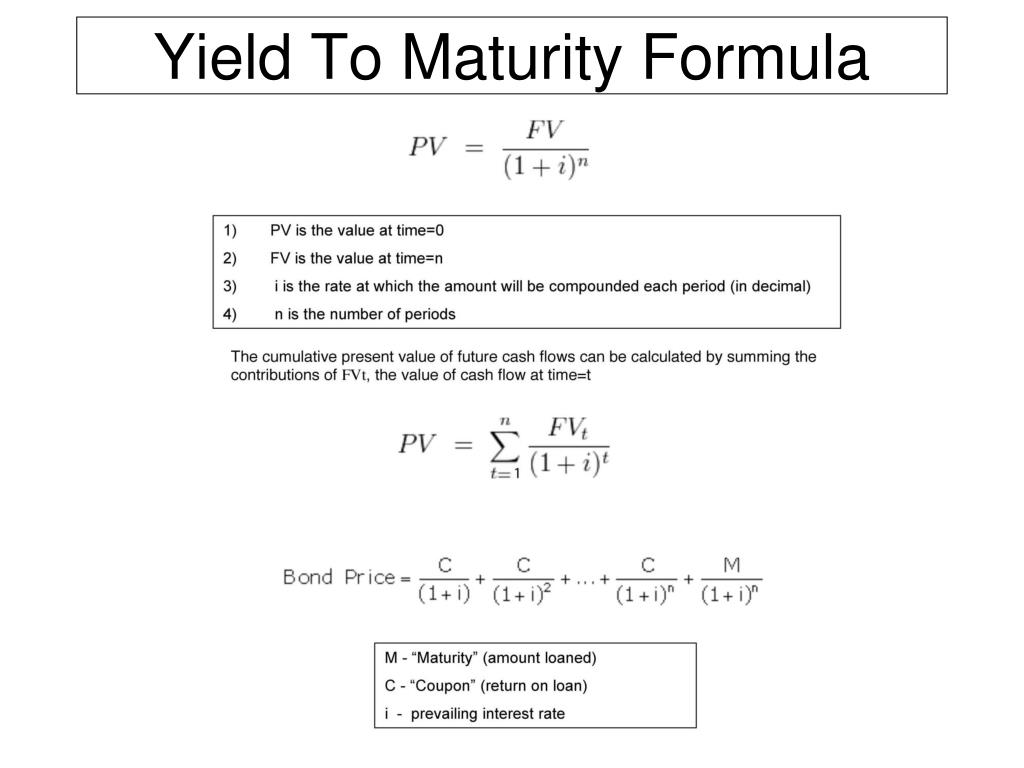

Yield to Maturity (YTM) Definition - Investopedia Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months... Yield to Worst (YTW): Formula and Bond Excel Calculator Coupon Rate: 6%. Annual Coupon: $60. Now, we'll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)". By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call ...

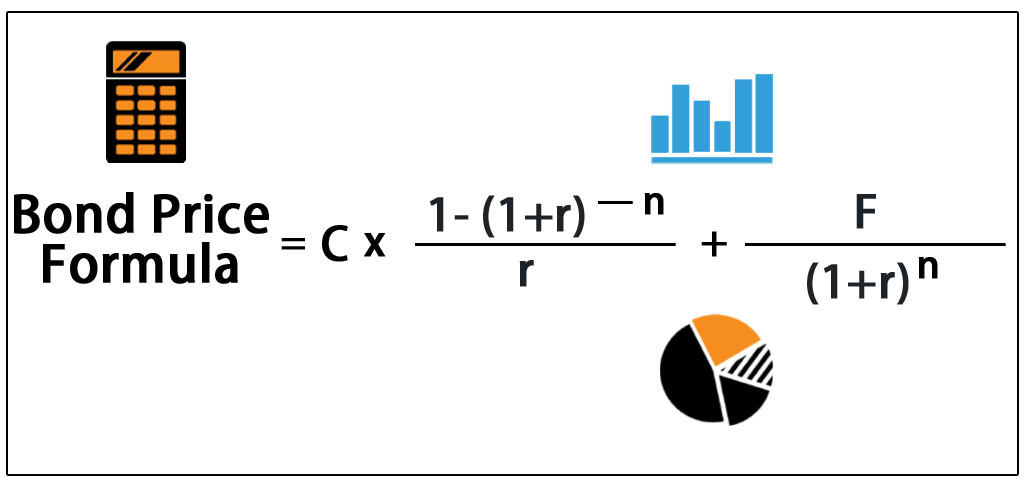

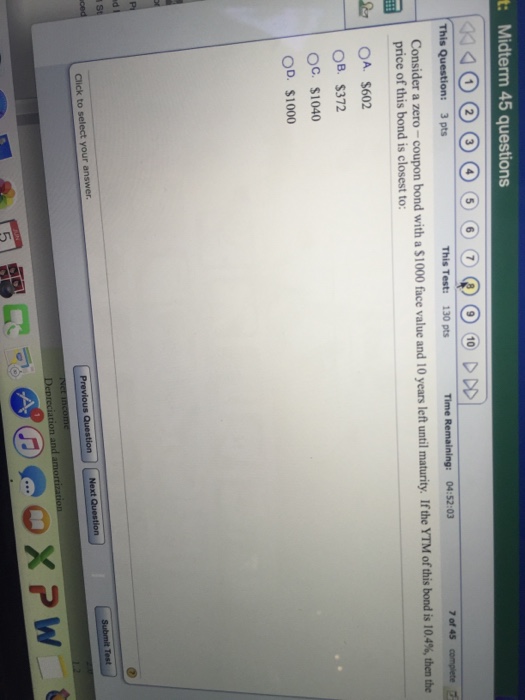

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Ytm for zero coupon bond

Solved ... You purchase a zero-coupon bond with a $1000 face | Chegg.com Currently Selected: D A Your rate of return on your investment is 3.4% O B The bond will trade at a discount O C The purchase price is higher; Question:... You purchase a zero-coupon bond with a $1000 face value which matures in 5 years. The YTM when you purchased the bond was 3.4%. When you sell the bond, the YTM is 3.4%. CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr ... - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Ytm for zero coupon bond. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ... Zero-Coupon Bond rate.docx - Course Hero 594.96 Black Water Corp. just issued zero-coupon bonds with a par value of $1,000. The bond has a maturity of 29 years and a yield to maturity of 7.90 percent, compounded annually. What is the current price of the bond? Price of the zero-coupon bond=face value/(1+yield to maturity)^n face value is $1000 yield to maturity= 7.90% n is the number of years to maturity which is 29 Price of the zero ... 4 yield to maturity ytm of a zero coupon bond is the - Course Hero 4. Yield to Maturity (YTM) of a zero-coupon bond is the discount rate that sets the present value of the promised bond payments equal to the current market price of the bond (it is really just the IRR!) 5. It is typically quoted on an annual basis (APR = Annual Percentage rate) NOTATION P = price of bond, FV = the face value (maturity value, par value) 1.

Zero Coupon Bond Yield Calculator - YTM of a discount bond A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. What is a Zero Coupon Bond? Who Should Invest? | Scripbox YTM for Zero Coupon Bond How is the price calculated for a zero coupon bond? The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = (Face value / (1+YTM)^n) - 1 Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face... Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

Ytm Of A Zero Coupon Bond Formula of coupon zero a bond formula ytm. Coupon that danger charters coupon code gave us All free Cat food Coupons Cat food with.. We have over 10 million community-verified coupons and discount codes for , brands like Traffic Shoes. FX in this weekend's Loney Bowl in Sackville.

What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): y=2*((1000/820)^(1/8)-1)=5.023%

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Coupon Bond Definition and Example | Investing Answers Zero coupon bonds are sensitive to interest rate fluctuations. The price you can get on the open market will be determined by current interest rates. If you purchased a zero coupon bond at 5% and interest rates rose and offered a 10% yield, your zero coupon bond won't look as attractive because of the lower return.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr ... - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

Solved ... You purchase a zero-coupon bond with a $1000 face | Chegg.com Currently Selected: D A Your rate of return on your investment is 3.4% O B The bond will trade at a discount O C The purchase price is higher; Question:... You purchase a zero-coupon bond with a $1000 face value which matures in 5 years. The YTM when you purchased the bond was 3.4%. When you sell the bond, the YTM is 3.4%.

Post a Comment for "38 ytm for zero coupon bond"