42 what is zero coupon bonds

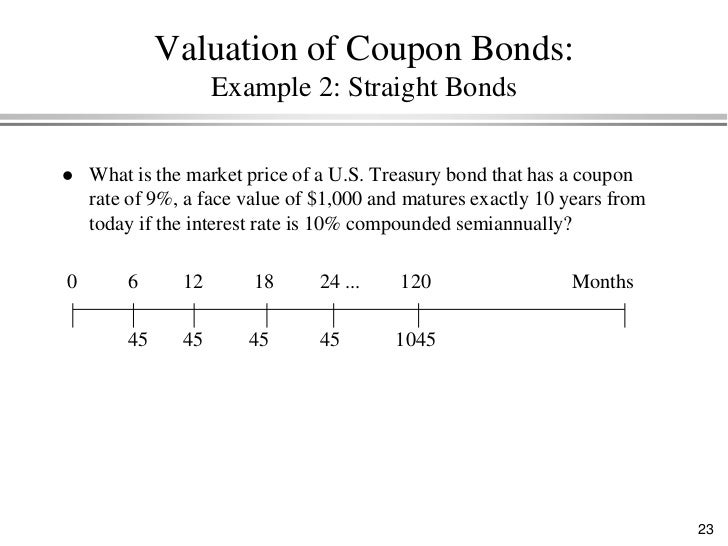

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds are meant for those investors who want to avoid market risk involved in the share market. Zero Coupon Bonds assures a fixed maturity amount after a certain period. Therefore, the investors who have want to get a fixed return in future with less market risk should go for these bonds.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,...

What is zero coupon bonds

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

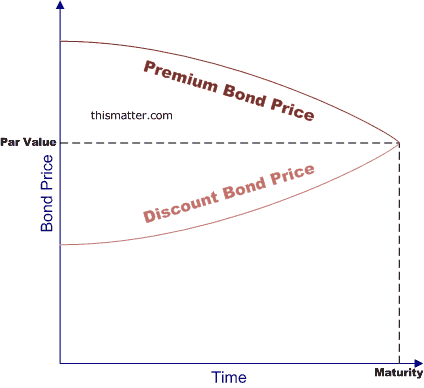

What is zero coupon bonds. Zero Coupon Bond - Explained - The Business Professor, LLC A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value. The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned.

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it. For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. What is a Zero Coupon Bond? - ICICIdirect Zero-coupon bonds, unlike other bonds, do not give investors a regular interest pay-out. Instead, they are issued at a steep discount to the bond's face ... Zero Coupon Bond | FXCM Markets For example, a zero coupon bond with a face value of US$1,000 due in 20 years will be offered at a price of US$200. The difference between the US$200 offering price and the eventual US$1,000 maturity value is the accumulated interest. By contrast, a traditional US$1,000 bond with a 3% coupon is offered at US$1,000, and the investor receives ...

Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Zero coupon, zero principal bond declared securities - The Hindu ... The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including corporates to utilise their fund marked for ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. When the bond reaches maturity, its investor receives ...

What Is a Zero-Coupon Bond? | The Motley Fool Also known as accrual bonds, zero-coupon bonds are debt securities that are sold at a deep discount for a price far below their face value. The reason? Unlike traditional bonds, zero-coupon bonds...

Post a Comment for "42 what is zero coupon bonds"