42 a 10 year bond with a 9 annual coupon

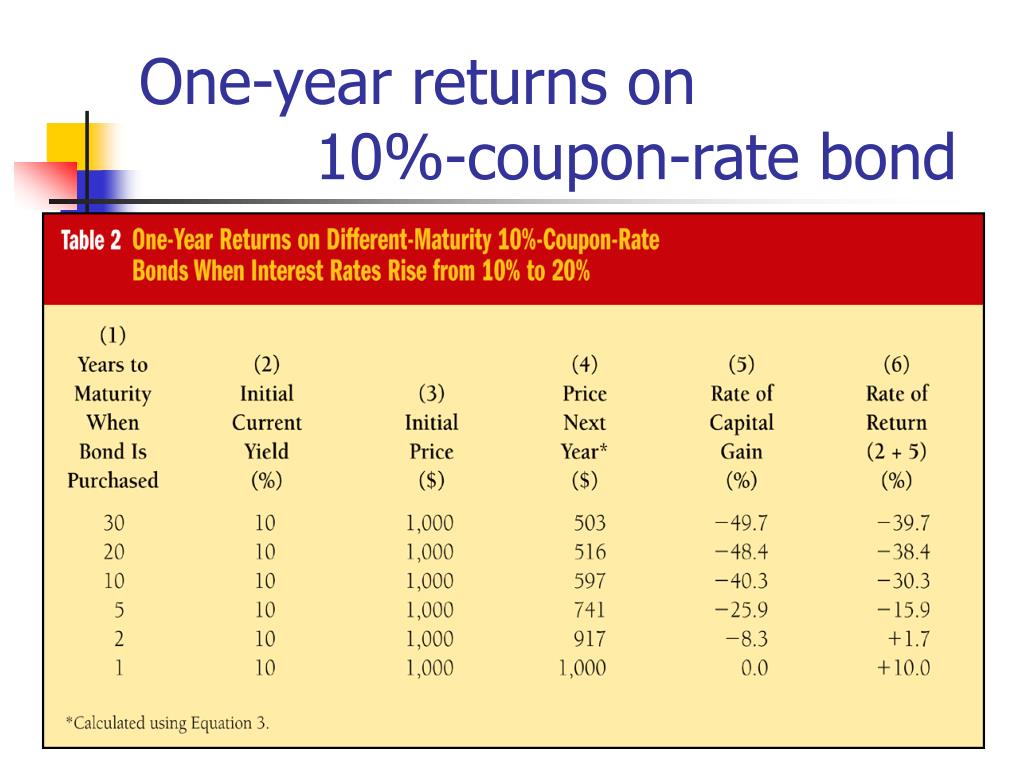

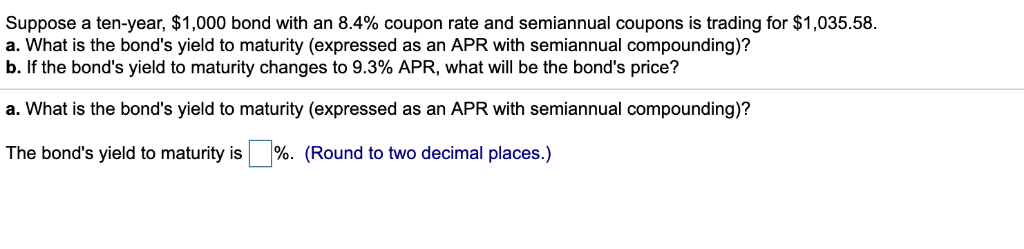

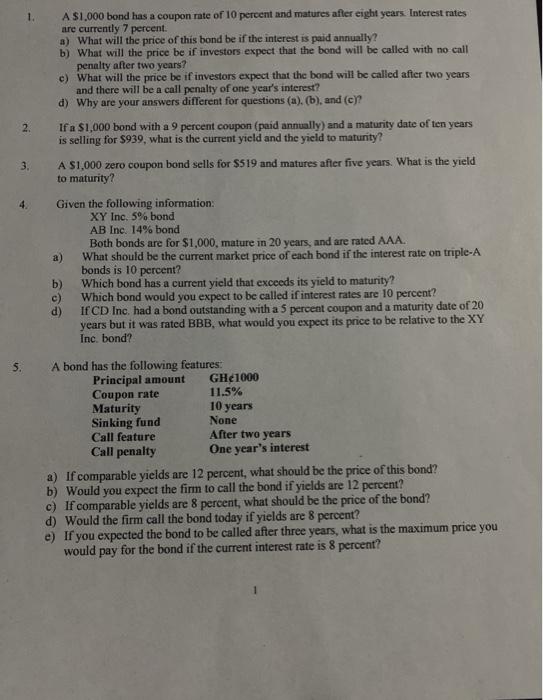

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ... Consider a 10 year semi annual coupon paying bond York, Inc. issued 6%, semi-annual coupon bonds outstanding with 10 years to maturity. The bond's par value is a) 3.49% b) 3.58% c) 7.16% d) 8.29% e) 6.00% c) N=10*2=20, I=8.42/2=4.21%, PMT=(0.06*1000)/2, FV=1000 => PV=838.57, Current yield = Annual coupon payment/current price = 60/838.57 = 7.16% (Fall 2009 1)

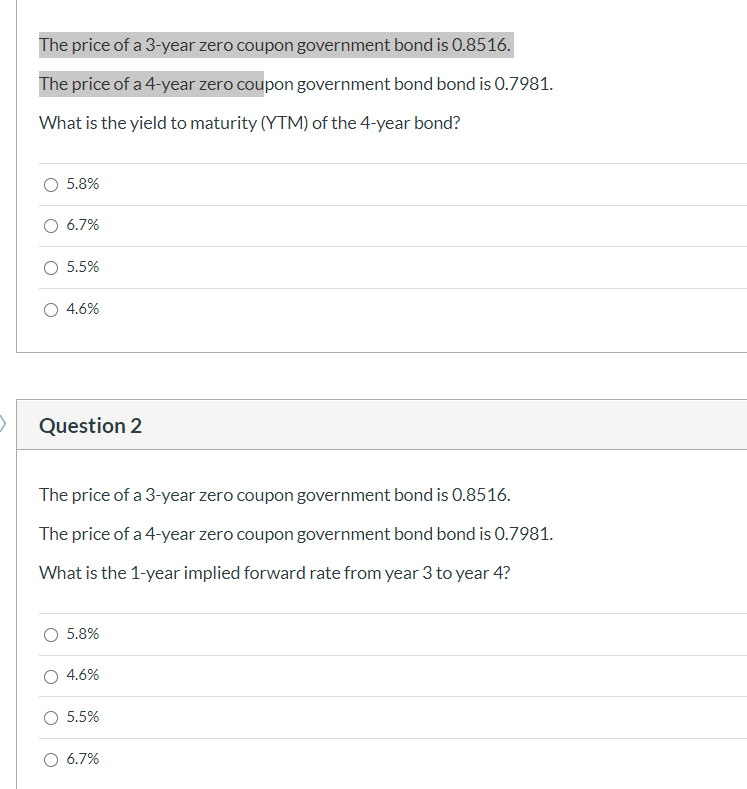

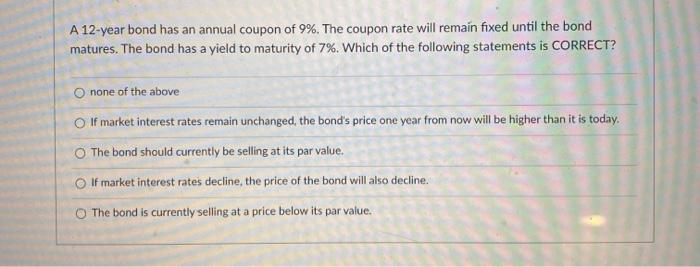

chapter5practicetest.docx - A 10-year bond with a 9% annual... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select one: a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b.The bond is selling below its par value. c.The bond is selling at a discount. d.If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price.

A 10 year bond with a 9 annual coupon

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. The bond is selling below its par value. The bond is selling at a discount. Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond s yield to maturity? Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

A 10 year bond with a 9 annual coupon. Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue Question 12 a 10 year bond with a 9 annual coupon has Selected Answer : One year from now , Bond A 's price will be higher than it is today . Correct Answer : One year from now , Bond A 's price will be higher than it is today . Question 13 Bond A has a 9% annual coupon while Bond B has a 6% annual coupon. Both bonds have a 7% yield to maturity, and the YTM is expected to remain constant. A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price ? A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value. b. the bond is selling at a discount. c. the bond will earn a rate of return greater than 8%.

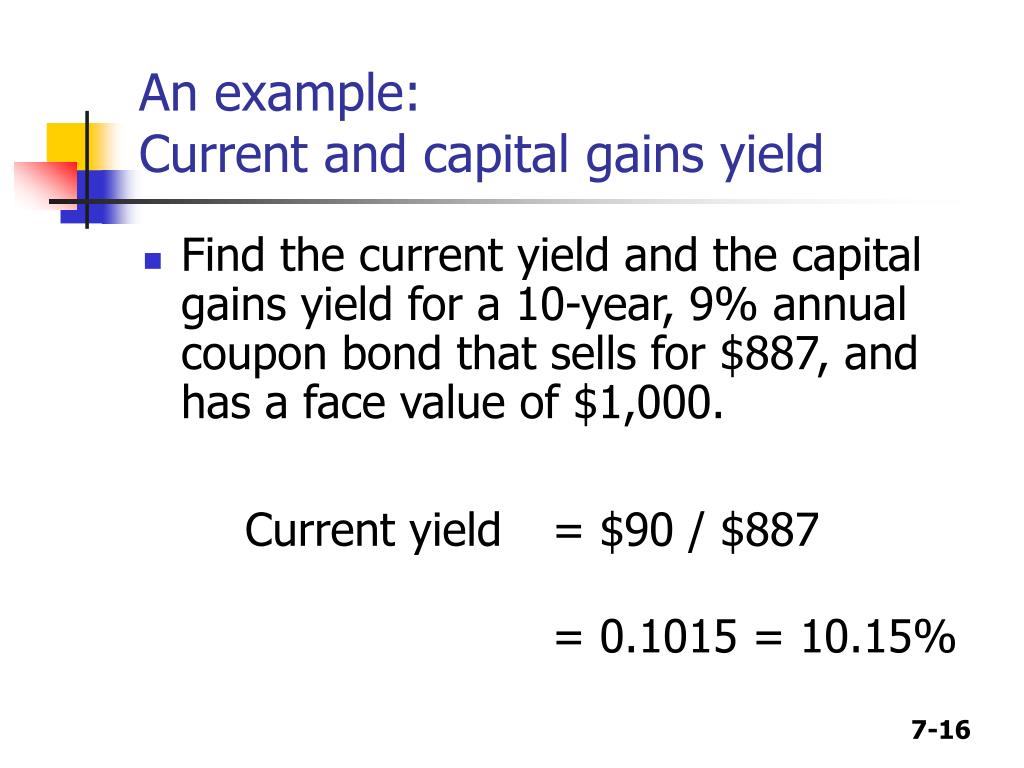

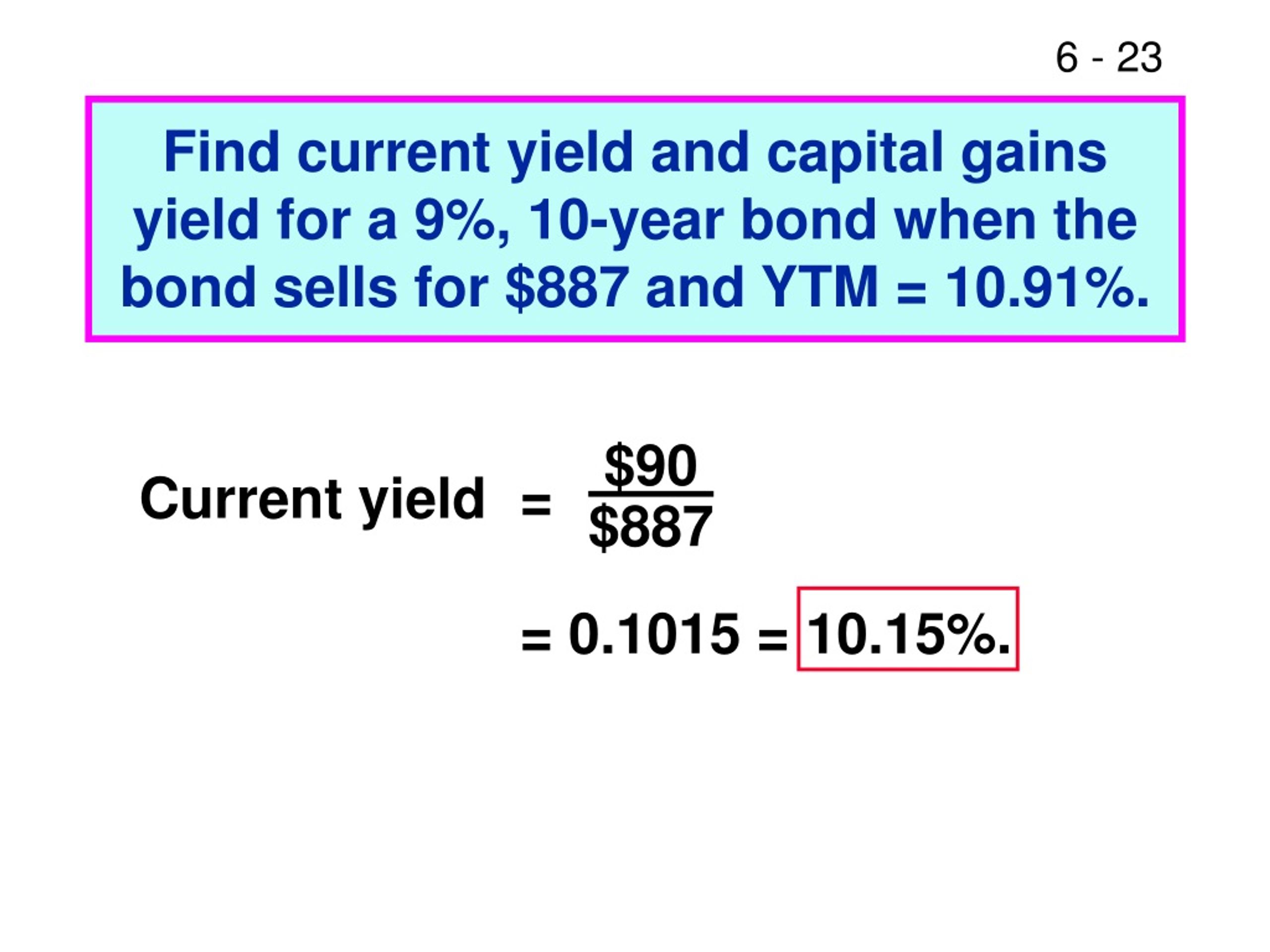

FINN 3226 CH. 4 Flashcards | Quizlet The bond's coupon rate is less than 8%. A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. Suppose you purchase a ten-year bond with 9% annual coupons. You hold ... Coupon=100*0.09=9. YTM=0.0866. n = years to maturity, in our case, 10. So, what you pay for the bond is as follows. When you sell the bond, after receiving the 4th coupon, there is still 6 remaining coupons and the face value to be paid, so, the sell price in year 4 is: So the cash flow received by hold this bond for 4 years is: Answered: A 10-year corporate bond has an annual… | bartleby Answers: The bond's yield to maturity is 3.78%. The bond's current yield is 5%. If the bond's yield to maturity remains constant, the bond's price will remain at par. The bond's capital gain yield is 0%. A 10-year corporate bond has an annual coupon payment of 5%. The bond is currently selling at par ($1,100). [Solved] A 10-year bond with a 9% annual coupon has a yield to maturity ... 53. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price.

Answered: A 9% semiannual coupon bond matures in… | bartleby Q: A bond has a $1,000 par value, 7 years to maturity, and a 9% annual coupon and sells for $1,095.… A: A bond is a financial security that is sold by large entities to borrow funds. Generally, it is… A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10 year bond with a 9 annual coupon has a yield to maturity of 8 Which of the A 10 year bond with a 9 annual coupon has a yield to School Enderun Colleges Course Title ACCOUNTING 109 Uploaded By LieutenantGoat2057 Pages 6 This preview shows page 4 - 5 out of 6 pages. View full document See Page 1 A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid... A 10-year $1,000 par value bond has a 9% semiannual - SolutionInn A 10-year $1,000 par value bond has a 9% semiannual A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

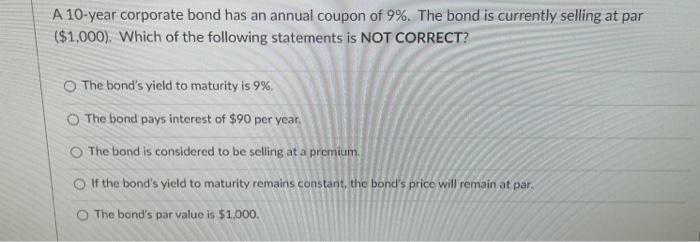

A 10-year corporate bond has an annual coupon of 9%. The bond… A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? Answer a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. If the bond's yield to maturity remains constant ...

3. A 10-year corporate bond has an annual coupon of 9%. The… - JustAnswer I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond's yield to maturity?

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

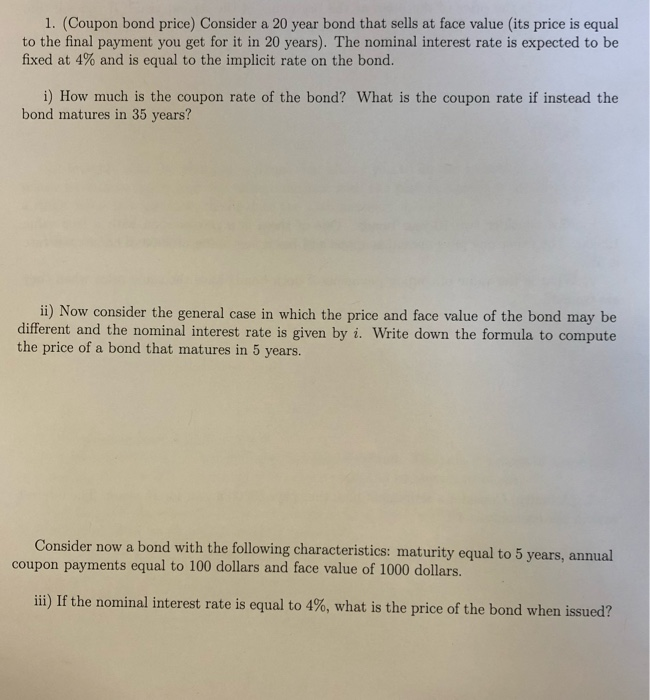

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Finance questions and answers. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value.

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84.

What is the yield to maturity for a 3 year bond with a 10% annual ... The yield of maturity will be 10% itself , Option C is the right answer.. The missing option are. What is the yield to maturity for a 3 year bond with a 10% annual coupon if the bond is trading at par? A) 11.00%. B) 9.00%. C) 10.00%. D) 9.75%

Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond s yield to maturity?

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. The bond is selling below its par value. The bond is selling at a discount.

Post a Comment for "42 a 10 year bond with a 9 annual coupon"