41 irs quarterly payment coupon

2020 Quarterly Tax Payment Coupons - Updated 2022 31.5 new 2020 Quarterly Tax Payment Coupons results have been found in the last 107 days, which means that every 26.75, new information is figured out. As Couponxoo's tracking, online shoppers can recently get a save of 18% on average by using our coupons for shopping at 2020 Quarterly Tax Payment Coupons. This is easily done by searching on ... 2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms - Illinois 2022 IL-501 Payment Coupon Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL-501 online; Click here to download the PDF payment coupon ... Internal Revenue Service (IRS) Additional Related Sites; Stay Connected Web Accessibility ...

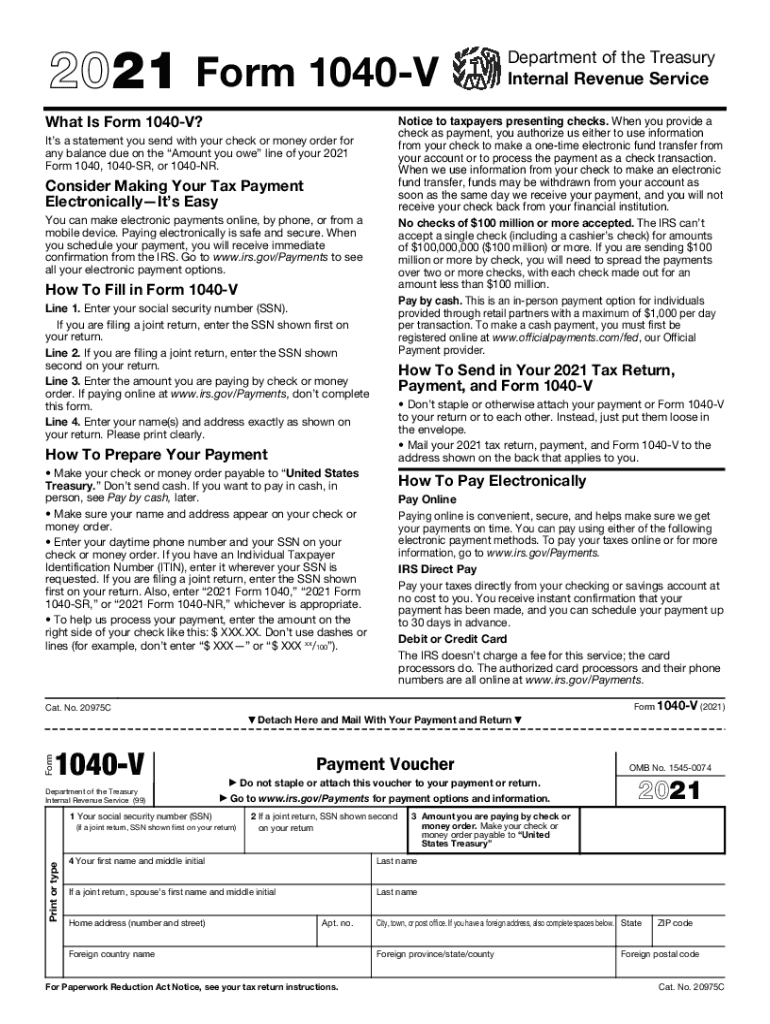

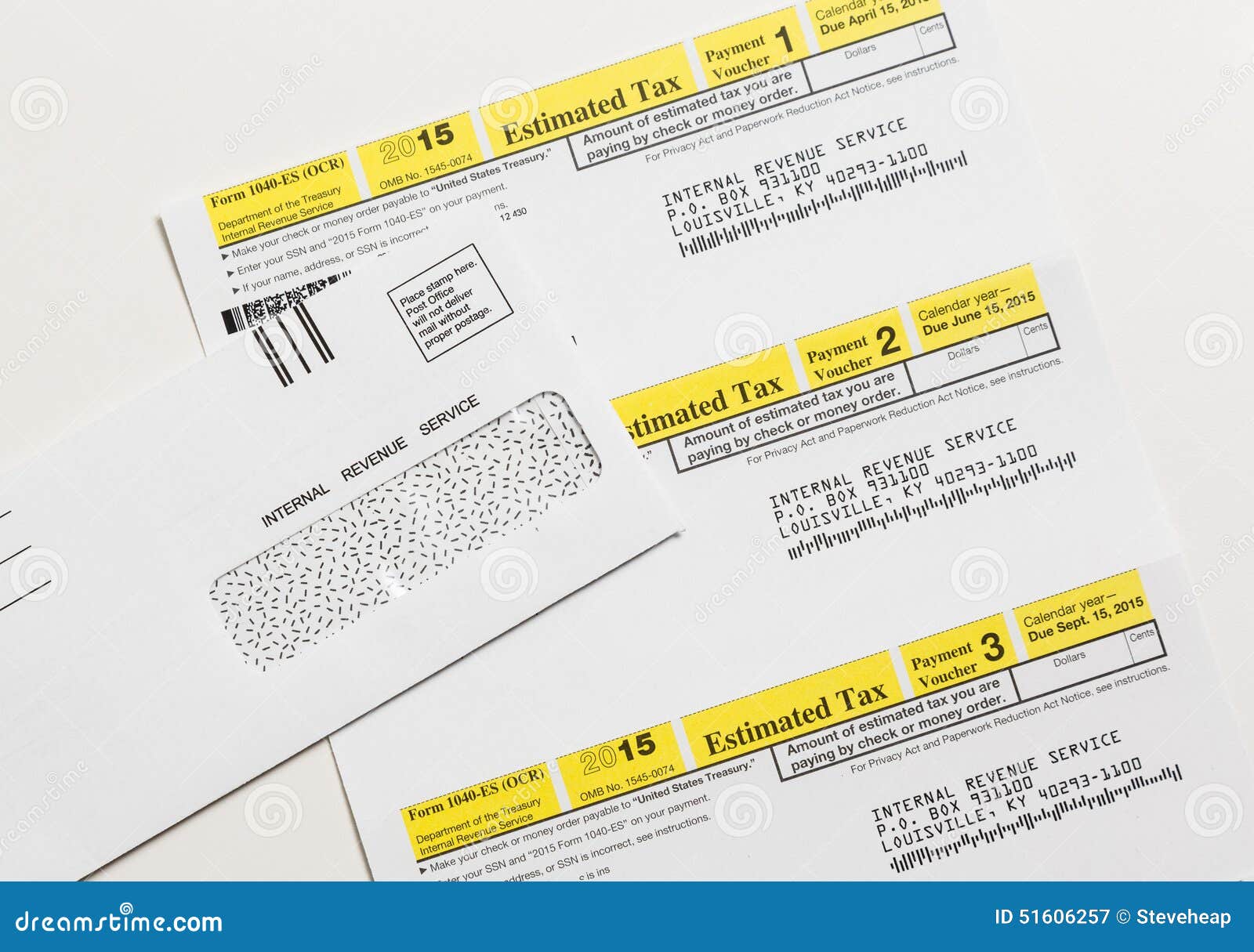

About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

Irs quarterly payment coupon

7 Ways To Send Payments to the IRS - The Balance You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 tax returns. You should submit your tax payment along with your ... PDF Employer's Quarterly Tax Payment Coupon UIA 1028 (Employer's Quarterly Wage/Tax Report). Make your check/money order payable to: Unemployment Insurance Agency (UIA). In order to ensure your account is properly credited, please include your 10-digit UIA Employer Account Number on your check or money order. In order to avoid penalties and interest, your tax return and payment must be ... Quarterly Tax Payment Voucher - English | DES - NC Mailing address: P.O. Box 25903. Raleigh, NC 27611-5903. DES Central Office Location: 700 Wade Avenue. Raleigh, NC 27605. Please note that this is a secure facility. Customers needing assistance with their unemployment insurance claim should contact us via phone at 888-737-0259.

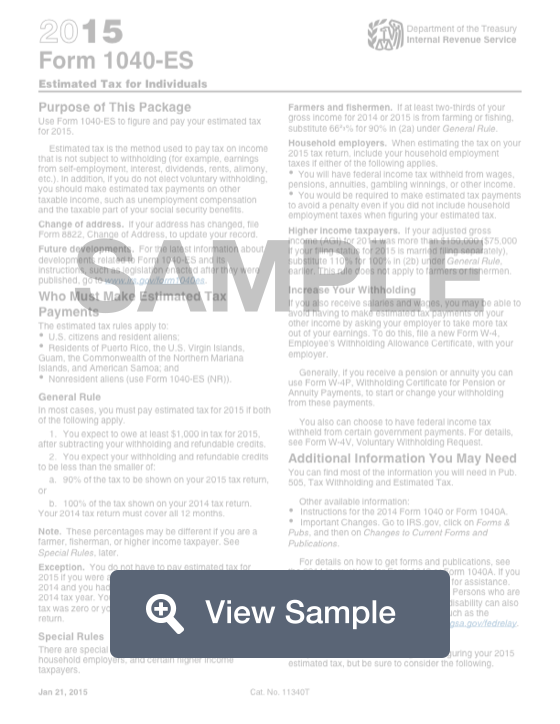

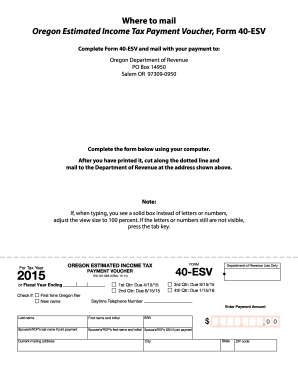

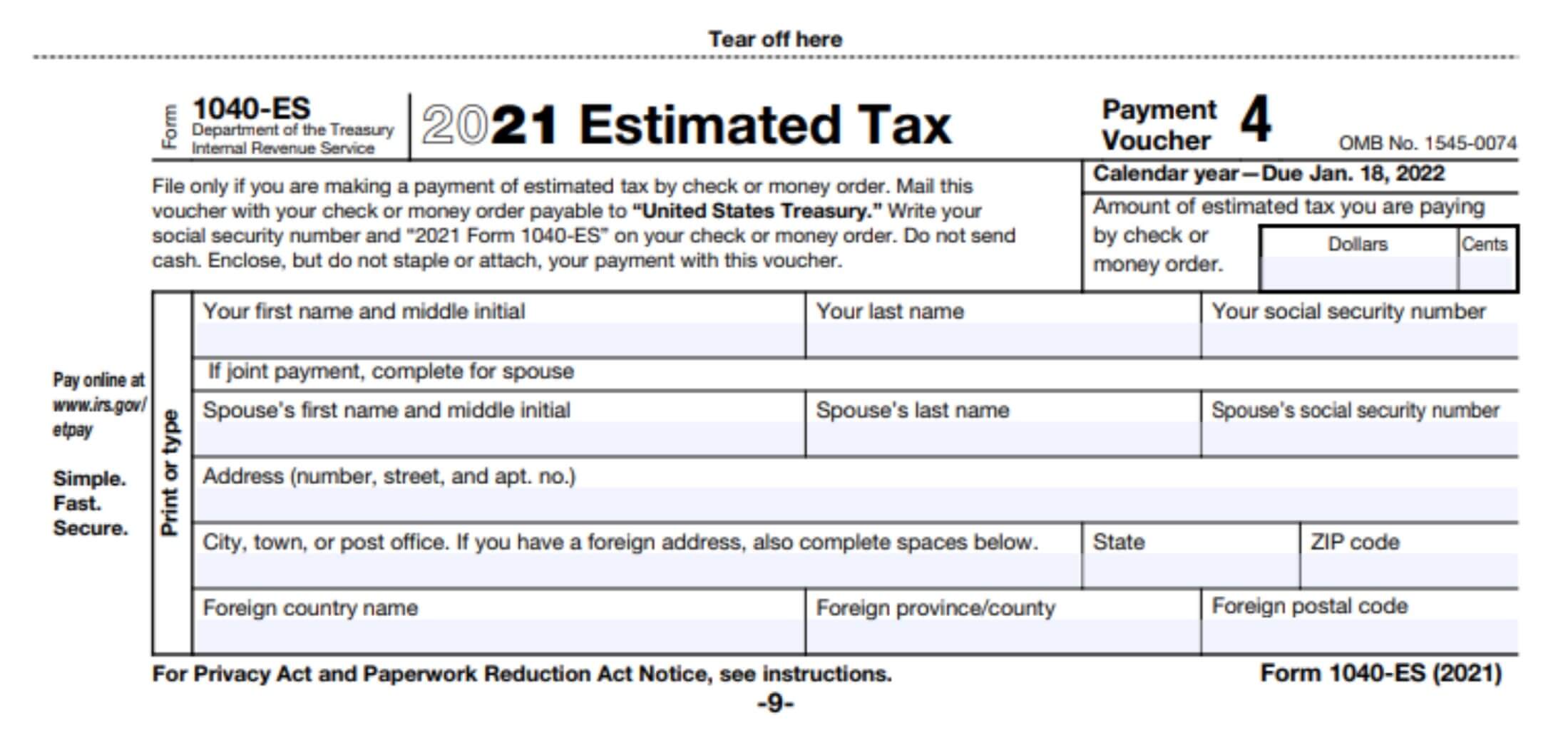

Irs quarterly payment coupon. 2022 1040-ES Form and Instructions (1040ES) - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023 Each quarterly estimated tax payment should be postmarked on or before the quarterly due date. Third quarter estimated tax payments due Sept. 15 IR-2020-205, September 9, 2020. WASHINGTON — The Internal Revenue Service today reminded the self-employed, investors, retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due September 15. Taxes are paid as income is received during the year through withholding from pay, pension or ... PDF 2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding, IRS: Sept. 15 is the deadline for third quarter estimated tax payments ... IR-2022-157, September 6, 2022 WASHINGTON — The Internal Revenue Service reminds taxpayers who pay estimated taxes that the deadline to submit their third quarter payment is September 15, 2022. Taxpayers not subject to withholding, such as those who are self-employed, investors or retirees, may need to make quarterly estimated tax payments.

Payments | Internal Revenue Service - IRS tax forms For individuals only. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account. How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ... Irs Quarterly Payment Coupons - bizimkonak.com For those who make estimated federal tax payments, the … CODES (4 days ago) The 2022 Form 1040-ES, Estimated Tax for Individuals, can help taxpayers estimate their first quarterly tax payment. Income taxes are a pay-as-you-go process. This means, by law, … Visit URL. Category: coupon codes Show All Coupons Forms and Instructions (PDF) - IRS tax forms 0118. 08/17/2021. Inst 1024-A. Instructions for Form 1024-A, Application for Recognition of Exemption Under Section 501 (c) (4) of the Internal Revenue Code. 0121. 01/03/2021. Form 1028. Application for Recognition of Exemption Under Section 521 of the Internal Revenue Code. 0906.

Irs Quarterly Payments For 2022 Coupon - fishfinderdiscounts.com Free unlimited Irs Quarterly Payments For 2022 Coupon with listing websites included hot deals, promo codes, discount codes, free shipping Irs Quarterly Payment Coupons 2021 - bizimkonak.com 38 irs quarterly payment coupon. CODES (6 days ago) PDF 2021 Form 1040-ES - IRS tax forms $5,400* *Only if married filing jointly. If married filing separately, these amounts do not apply. You. Visit URL. Category: coupon codes Show All Coupons . Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment. Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax)

Irs Quarterly Tax Payment Coupon 2020 - bizimkonak.com 2020 Quarterly Tax Payment Coupons - Updated 2022. CODES (2 days ago) The latest ones are on Jun 19, 2022. 40 new 2020 Quarterly Tax Payment Coupons results have been found in the last 112 days, which means that every 28, new information is figured … Visit URL. Category: coupon codes Show All Coupons

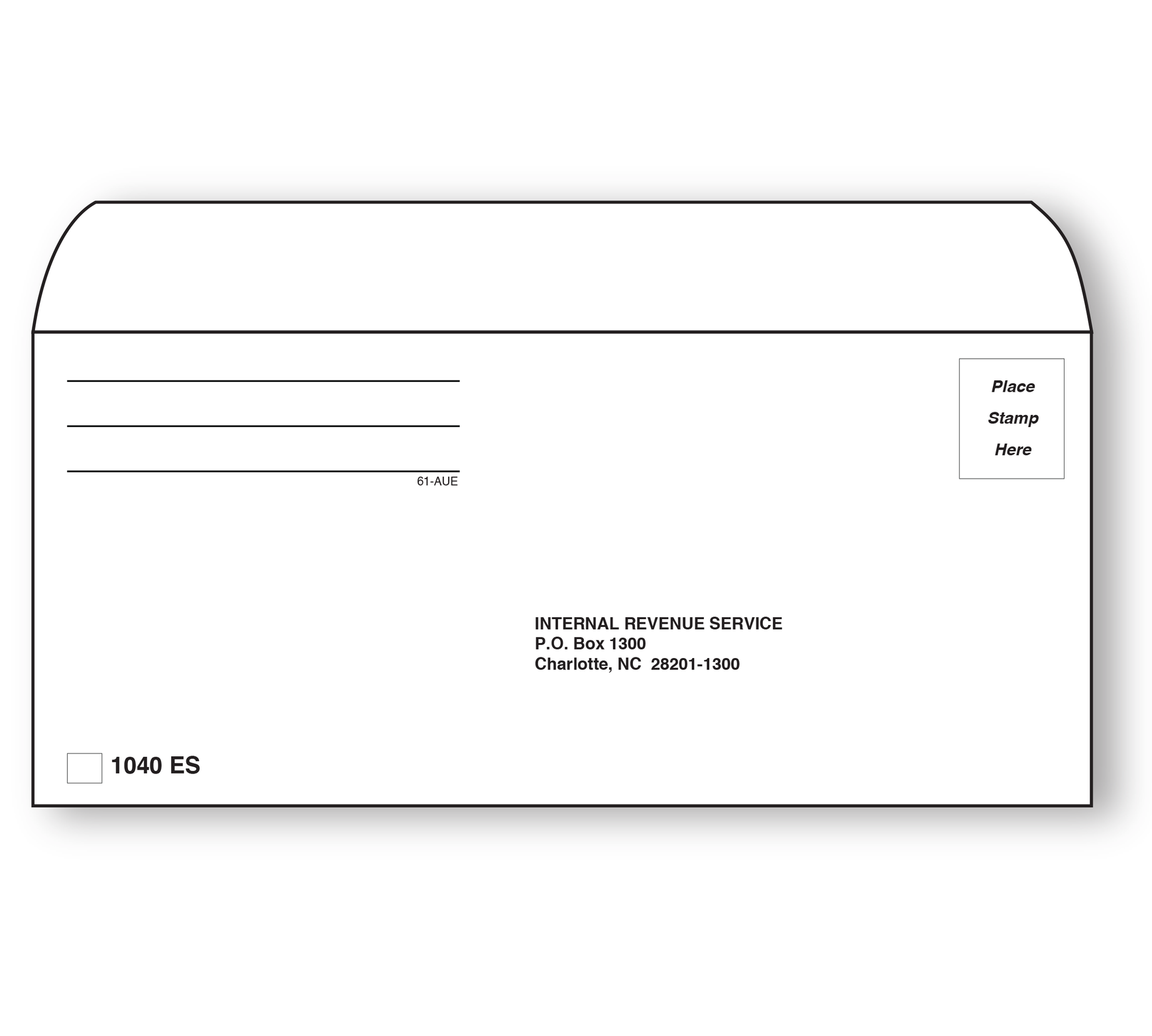

IRS Mailing Address: Where to Mail IRS Payments File The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ. ... The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201 ...

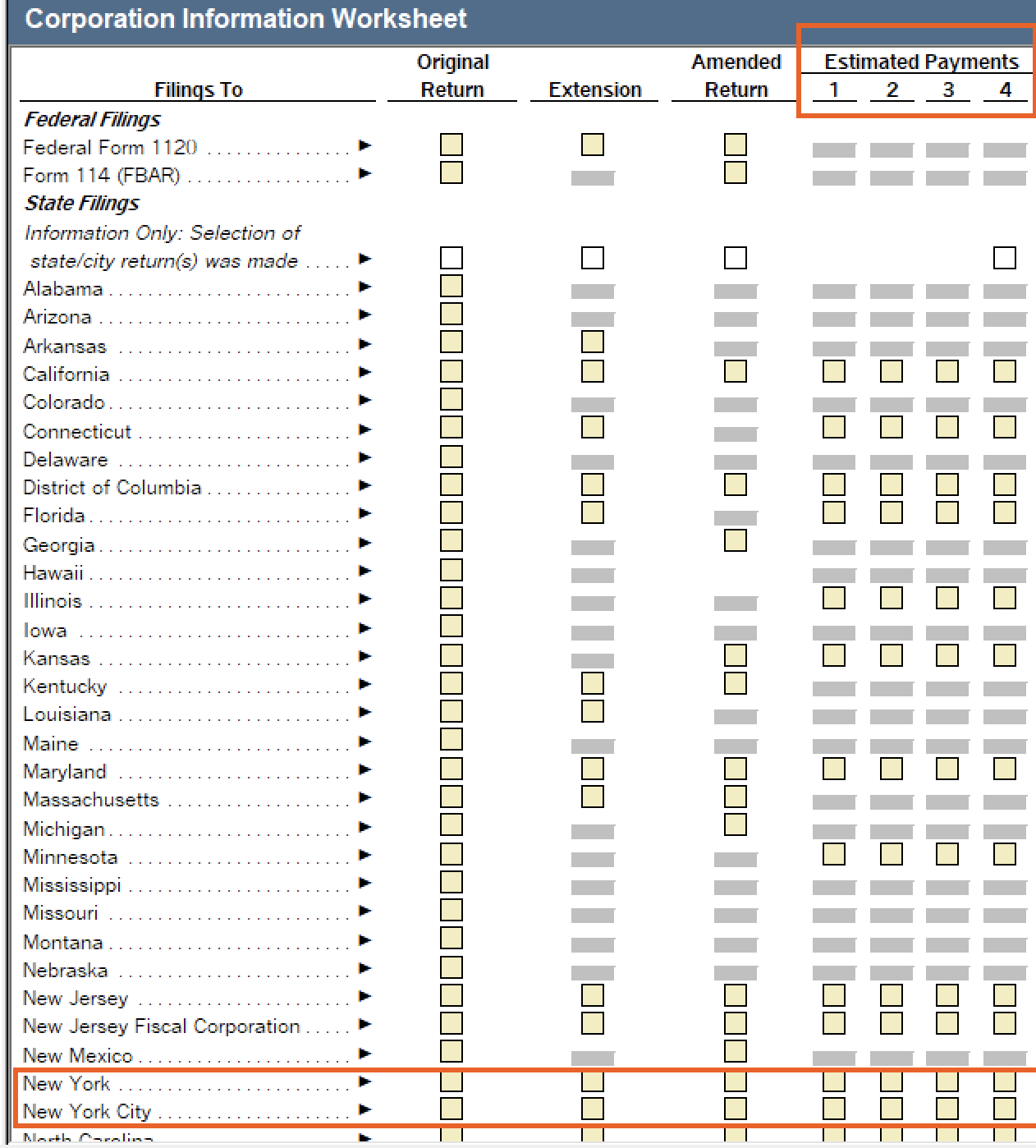

For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022 WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18.

2022 Federal Quarterly Estimated Tax Payments | It's Your Yale 2022 Federal Quarterly Estimated Tax Payments Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

directpay.irs.gov directpay.irs.gov

Irs Estimated Tax Payment Form 2022 Coupon Irs Estimated Tax Payment Form 2022 Coupon All Time Past 24 Hours Past Week Past month Listing: 17 Coupon Codes Cash Back Free Shipping Share Your Coupon Codes 2022 FORM 1040-ES - IRS TAX FORMS 20 hours ago FREE From irs.gov Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022.

About Form 1040-ES, Estimated Tax for Individuals Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable ...

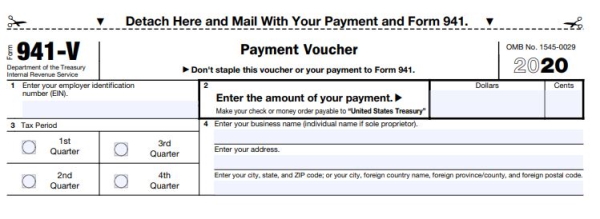

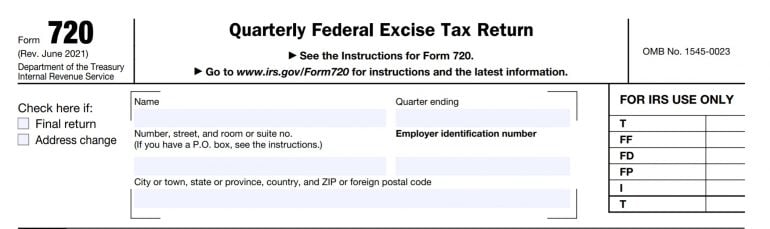

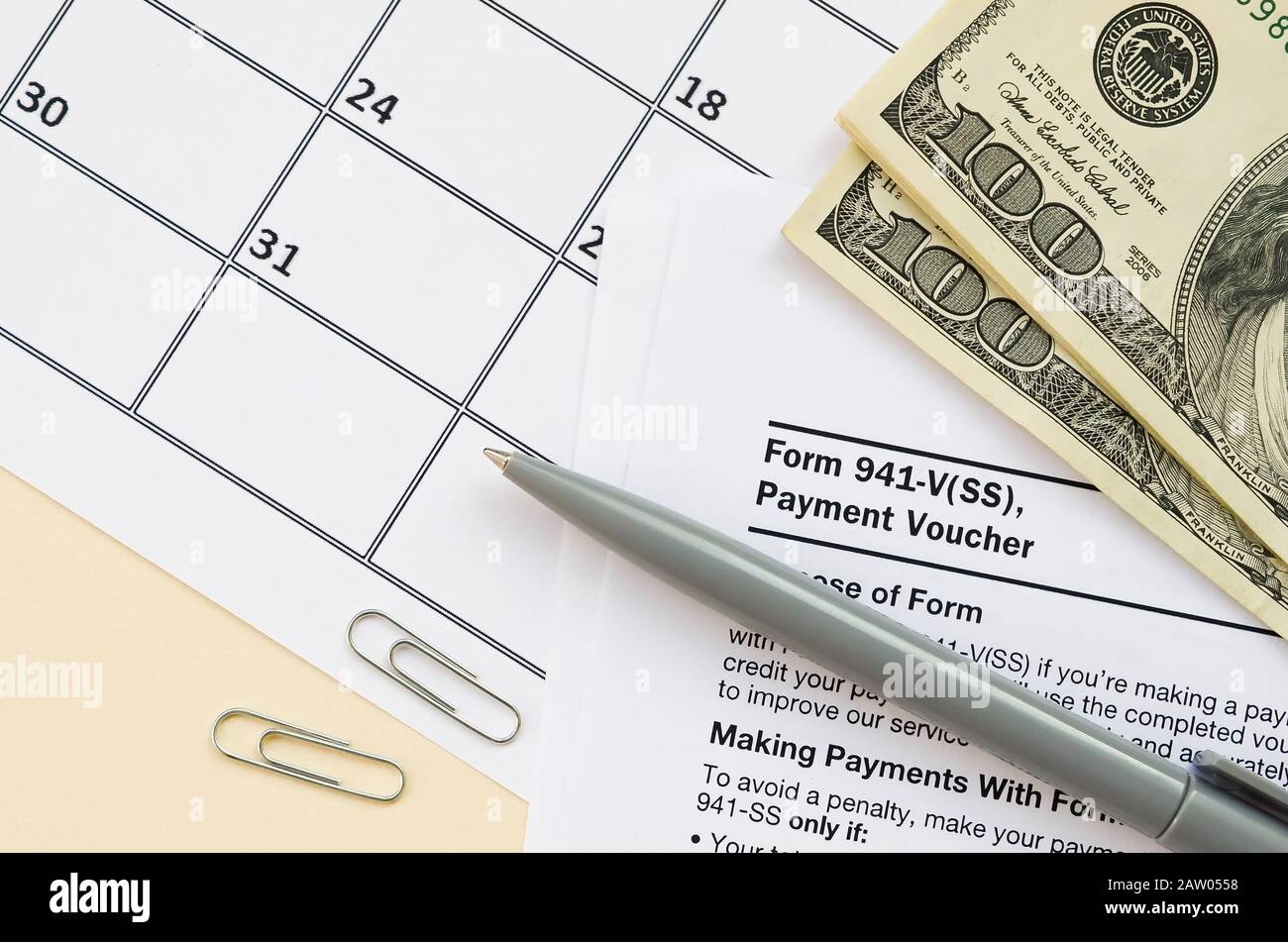

IRS Form 941: How to File Quarterly Tax Returns - NerdWallet Here's a step-by-step guide and instructions for filing IRS Form 941. 1. Gather information needed to complete Form 941. Form 941 asks for the total amount of tax you've remitted on behalf of your ...

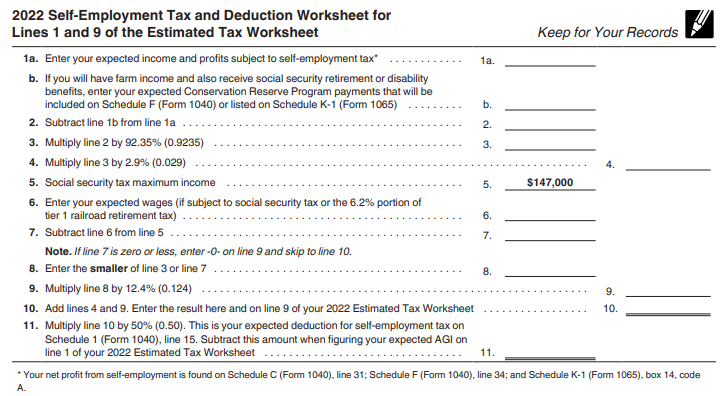

A Guide to Paying Quarterly Taxes - TurboTax Tax Tips & Videos The 100% requirement increases to 110% if your adjusted gross income exceeds $150,000 ($75,000, if you're married and file separately). One exception applies to individuals who earn at least two-thirds of their income from farming or fishing. The requirement is to pay in two-thirds of your current year tax or 100% of your prior year tax.

Estimated Taxes | Internal Revenue Service - IRS tax forms Coronavirus Aid, Relief, and Economic Security (CARES) Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020.

Quarterly Tax Payment Voucher - English | DES - NC Mailing address: P.O. Box 25903. Raleigh, NC 27611-5903. DES Central Office Location: 700 Wade Avenue. Raleigh, NC 27605. Please note that this is a secure facility. Customers needing assistance with their unemployment insurance claim should contact us via phone at 888-737-0259.

PDF Employer's Quarterly Tax Payment Coupon UIA 1028 (Employer's Quarterly Wage/Tax Report). Make your check/money order payable to: Unemployment Insurance Agency (UIA). In order to ensure your account is properly credited, please include your 10-digit UIA Employer Account Number on your check or money order. In order to avoid penalties and interest, your tax return and payment must be ...

7 Ways To Send Payments to the IRS - The Balance You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 tax returns. You should submit your tax payment along with your ...

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "41 irs quarterly payment coupon"