39 coupon rate formula calculator

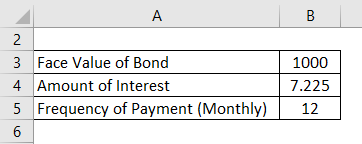

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form.

Coupon rate formula calculator

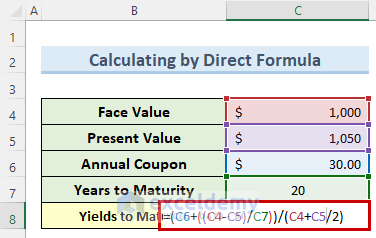

What Is a Coupon Rate? How To Calculate Them & What They're Used For C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. The annualized interest is the interest the investor or bondholder gets every year of the bond's duration till its maturity. While the par value is the amount the bond was purchased for. Current Yield Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

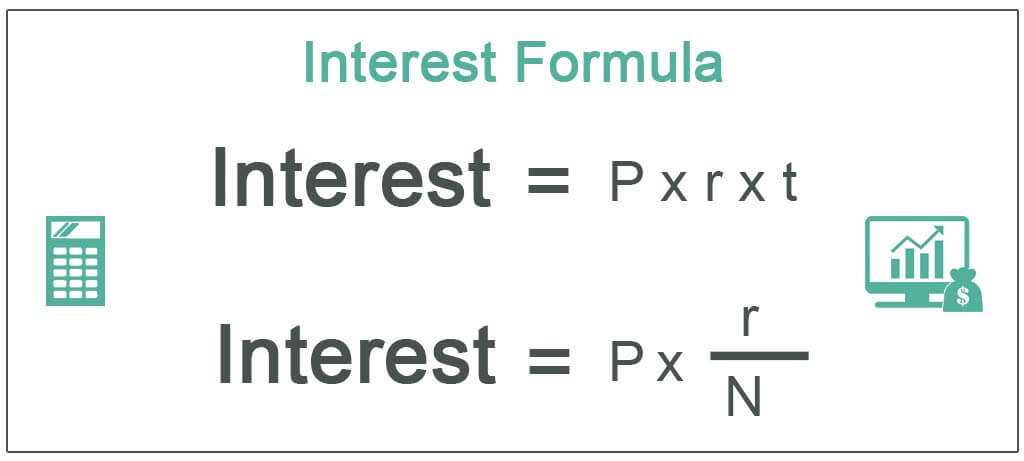

Coupon rate formula calculator. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ... What Is the Coupon Rate of a Bond? - The Balance Coupon Rate Formula The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator. Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value Finance Calculators Active Return Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Coupon Rate Formula & Calculation - Study.com Convert the resulted coupon rate to percentage terms by multiplying the resulted quotient by 100. All the mentioned above steps can be summarized in the coupon rate formula that is given such... Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of...

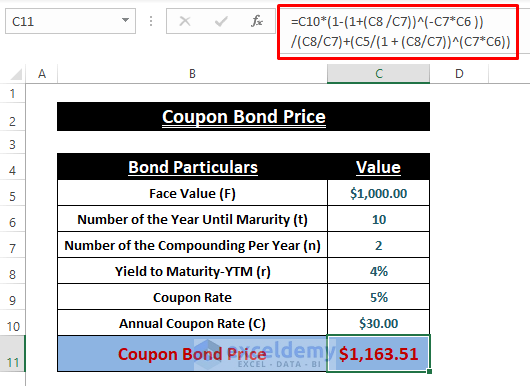

Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ... Coupon Rate Formula | Simple Accounting A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

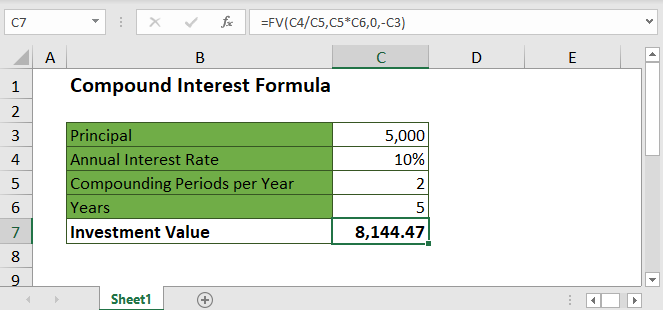

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

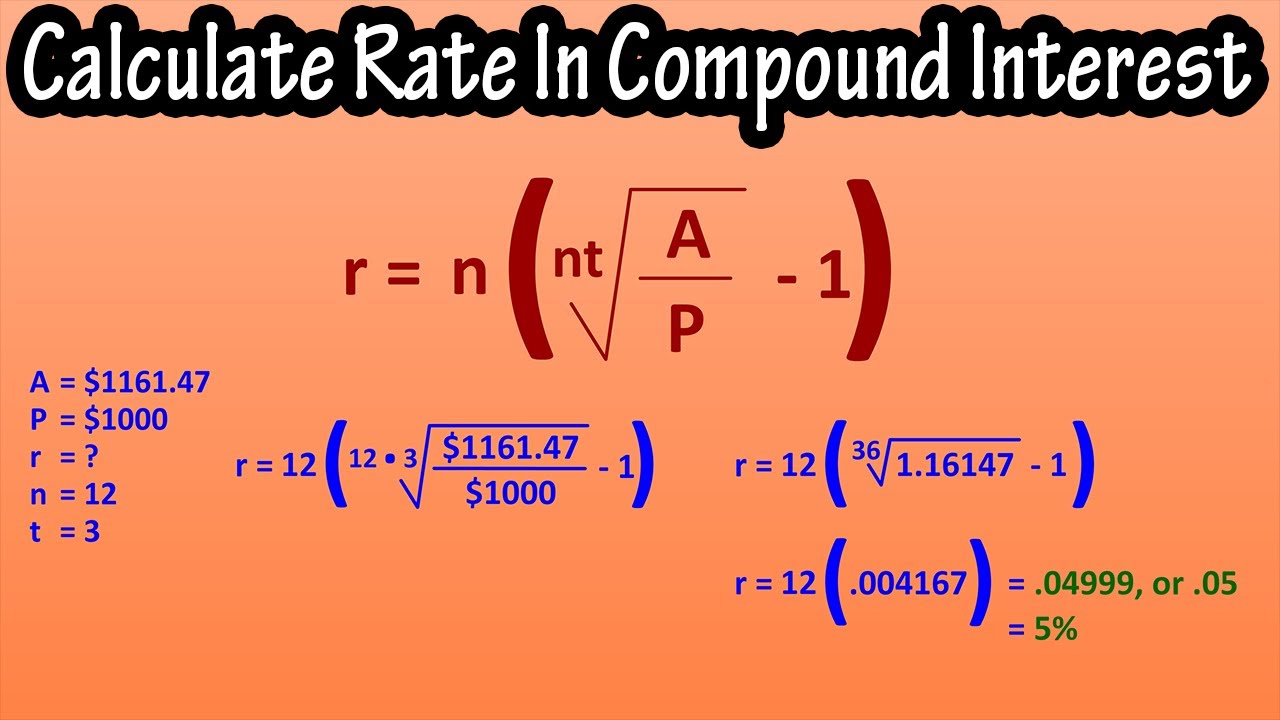

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

What Is a Coupon Rate? How To Calculate Them & What They're Used For C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. The annualized interest is the interest the investor or bondholder gets every year of the bond's duration till its maturity. While the par value is the amount the bond was purchased for. Current Yield

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "39 coupon rate formula calculator"