40 pricing zero coupon bonds

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 4:34p Here’s what stock-market investors are getting wrong about China and its zero-COVID policy, ... Coupon Rate 4.125%; Maturity Nov 15, 2032; Performance. 5 Day ... Related Bonds - Maturity ... MSN MSN

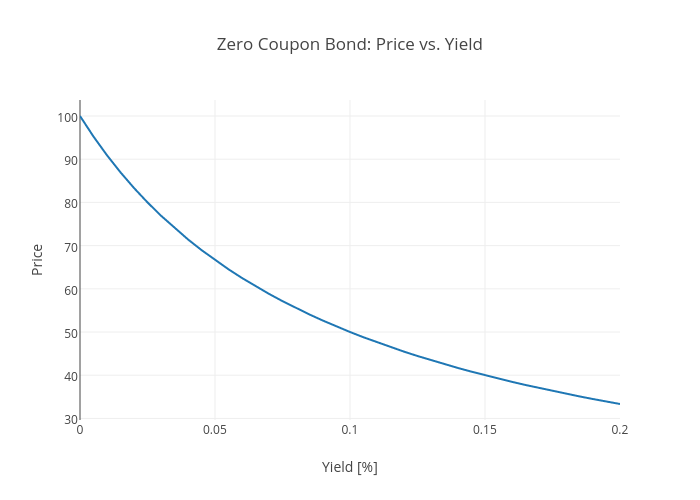

What are Zero-Coupon Bonds? (Characteristics + Calculator) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

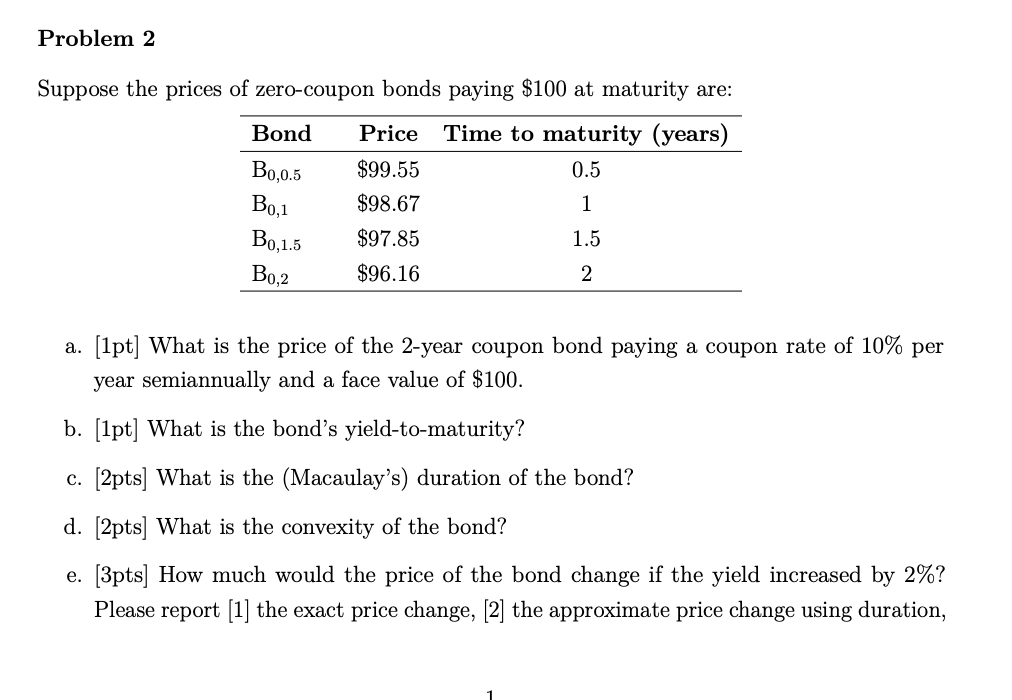

Pricing zero coupon bonds

Bond (finance) - Wikipedia The bondholder receives the full principal amount on the redemption date. An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons ... Fixed Income Pricing - Fixed Income | Charles Schwab Access Schwab's low and straightforward pricing and choose from hundreds of no-load, no-transaction-fee bond mutual funds. ... Zero-coupon Treasuries (including STRIPS) ... a broker and are subject to a $25 broker-assisted transaction fee. Large block transactions (orders of more than 250 bonds) may be eligible for special handling and/or ... Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Pricing zero coupon bonds. PlayStation userbase "significantly larger" than Xbox even if … Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Aug 31, 2020 · Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion. Business News, Personal Finance and Money News - ABC News Nov 10, 2022 · How China's zero-COVID policy threatens the US economy. Civil unrest in China over the weekend battered U.S. stocks. November 29, 2022. Inflation cools but stays near 40-year high. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Fixed Income Pricing - Fixed Income | Charles Schwab Access Schwab's low and straightforward pricing and choose from hundreds of no-load, no-transaction-fee bond mutual funds. ... Zero-coupon Treasuries (including STRIPS) ... a broker and are subject to a $25 broker-assisted transaction fee. Large block transactions (orders of more than 250 bonds) may be eligible for special handling and/or ... Bond (finance) - Wikipedia The bondholder receives the full principal amount on the redemption date. An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons ...

Post a Comment for "40 pricing zero coupon bonds"