45 what is zero coupon

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... Mountain Dew & Pepsi Zero Sugar 12-Packs, as Low as $2.06 at Target Combine a sale price along with a Circle offer and rebates to save big on Pepsi & Mountain Dew Zero Sugar Soda at Target. Soda 12-packs are on sale for $5 when you buy three. Plus, receive a $5 gift card with a purchase of $20 or more. Clip the 25% off Circle offer in the Target app (download here) or online.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

What is zero coupon

What Is a Zero-Coupon CD? - The Balance A zero-coupon CD is a certificate of deposit (CD) you purchase at a discount and that doesn't pay out periodic interest. You'll obtain the full value of the CD via interest earned once the CD reaches its maturity date. However, even though you won't receive regular interest payments, zero-coupon CDs usually come with a higher rate of return. How to Start Couponing When You Have Zero Time 6. Target, Walgreens, and CVS are the best stores to begin at. Pick one. Most of the grocery stores you'll be learning how to start couponing at have a loyalty program or app. You definitely want to get familiar with these so you can continue to save money on top of coupons. Here are a few loyalty programs to consider: How do you calculate a zero-coupon rate from the bond yield? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value indicates the investor's return. What is the current yield curve?

What is zero coupon. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These … › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. When shorter duration bonds offer a higher yield than longer duration bonds that is called yield curve inversion. If investors are … Zero Coupon Bond Value - Formula (with Calculator) - finance … A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The amount paid at maturity is called the face value. The term discount bond is used to reference how it is sold originally at a discount from its face value instead of standard pricing with periodic …

Zero Coupon Bond - Explained - The Business Professor, LLC A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value. The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable. Zero Coupon Bond: Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial... What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity … 14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term “compounding.” Zero Coupon 2025 Fund | American Century Investments Each Zero Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity. Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity. Zero Coupon Municipals Are About To Get Significantly ... - SeekingAlpha Zero coupon bonds are those that don't pay a regular interest coupon. Instead they're issued at a discounted price which when held to maturity and repayment would equal a useful interest rate.

Zero-Coupon CDs: What They Are And How They Work | Bankrate This type of deposit account is called "zero coupon" because "coupon" refers to a periodic interest payment and "zero" indicates that it does not incorporate such payments. How zero-coupon CDs work...

Zero coupon Definition & Meaning - Merriam-Webster Definition of zero coupon : of, relating to, or being an investment security that is sold at a deep discount, is redeemable at face value on maturity, and that pays no periodic interest zero coupon municipal bonds Examples of zero coupon in a Sentence

MC Explains | What is a 'zero-coupon, zero-principal' instrument? According to the gazette notification, "zero coupon zero principal instrument" is an instrument issued by a not-for-profit organisation that will be registered with the social stock exchange...

› terms › zZero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

What is the tax implication on zero coupon bonds? Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ...

How to Construct a Zero Coupon Yield Curve in Excel? Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ...

What is zero coupon bonds? - Zaviad A zero coupon bond is a debt security that doesn't pay periodic interest payments (coupons) to the bondholder. Instead, the bondholder receives the entire principal amount of the bond at maturity. For this reason, zero coupon bonds are also known as "discount" bonds, since the purchase price is lower than the face value of the bond.

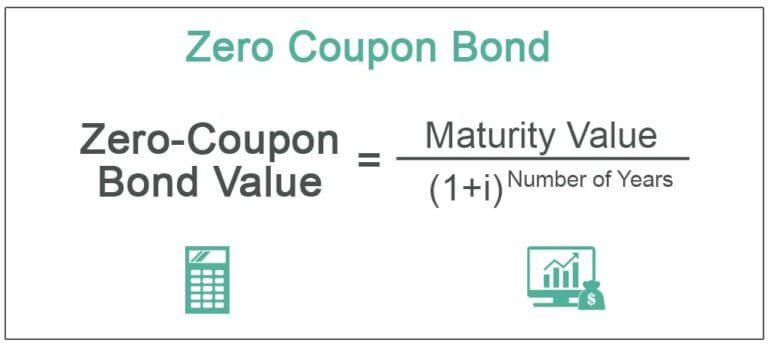

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Post a Comment for "45 what is zero coupon"