42 treasury bill coupon rate

United States - Treasury Bills: 26-week - High rate - economy.com Treasury Bills: 26-week - High rate for United States from U.S. Bureau of Public Debt for the Treasury auctions - 13- and 26-week (91- and 182-day) T-Bills release. ... but the coupon payments and underlying principal are adjusted to compensate for inflation as measured by the CPI. Therefore, the real rate of return is guaranteed, but the cost ... Treasury Bond (T-Bond) Definition - Investopedia 2.4.2022 · Treasury Bond - T-Bond: A Treasury bond (T-Bond) is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury bonds make interest payments semi ...

Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

Treasury bill coupon rate

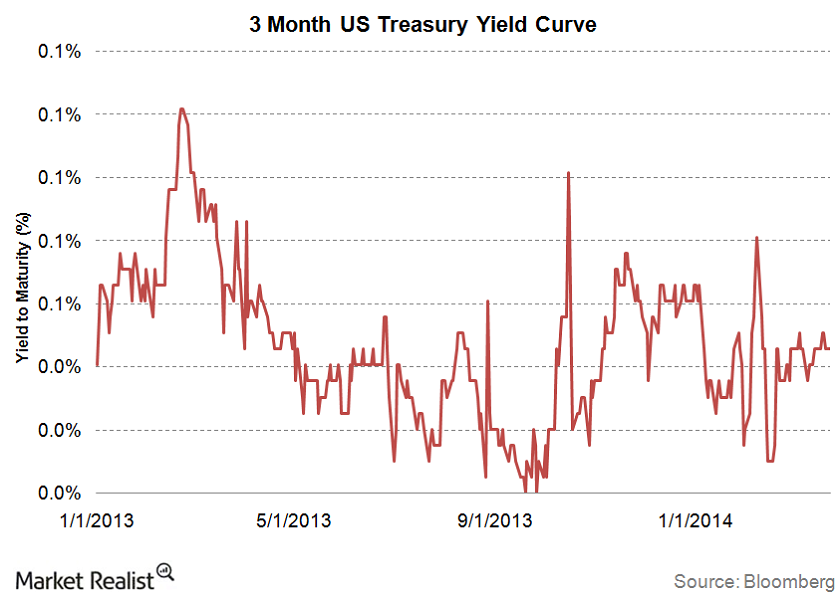

10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 4.17%, compared to 4.14% the previous market day and 1.53% last year. How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to... Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

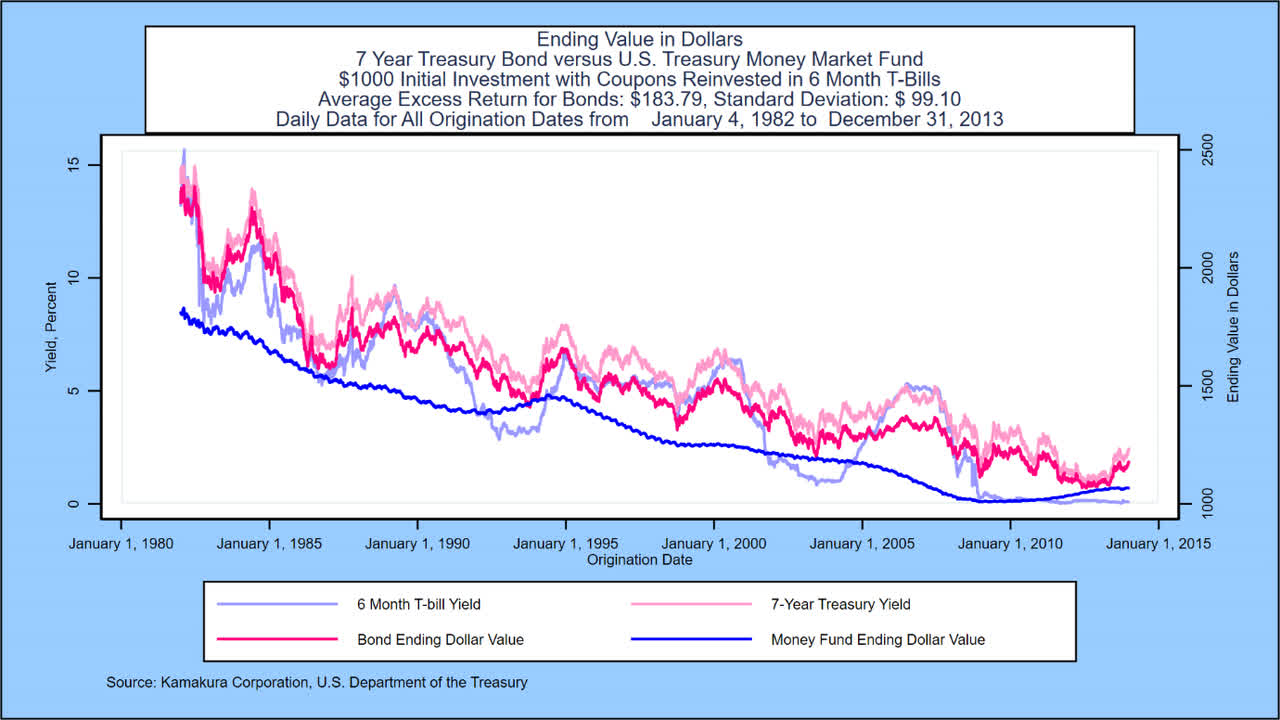

Treasury bill coupon rate. NASDAQ - Datastore NASDAQ - Datastore How Often Does The Treasury Bill Rate Change? - Inflation Hedging Currently, Treasury bill rates are hovering around 2% even for the 1 year bill. This can be contrasted with two years ago when the rates were much higher, around 4%, and also very close to current rate levels for the 2-3 and 3-4 year treasuries. In fact, on average Treasury Bill rates have a yield of around 4.5%. 6 Month Treasury Bill Rate - YCharts The 6 month treasury yield reached nearly 16% in 1981, as the Fed was raising its benchmark rates in an effort to curb inflation. 6 Month Treasury Bill Rate is at 4.50%, compared to 4.43% the previous market day and 0.07% last year. This is higher than the long term average of 4.48%. Stats Related Indicators Treasury Yield Curve Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

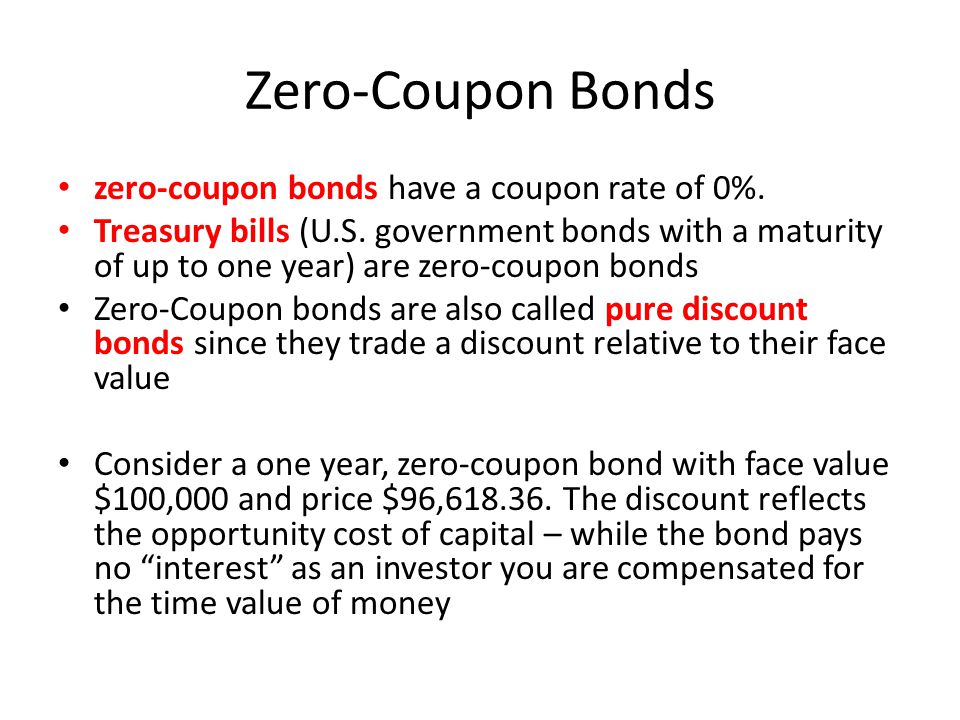

Treasury Coupon Bonds - Economy Watch The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate.[br] ... Some fixed income securities such as US Savings bonds and US Treasury Bills are zero coupon bonds. You can buy certain treasury ... United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different number … Should You Buy Treasuries? - Forbes With interest rates rising, government bonds have become a lot more attractive for investors searching for a return on cash. The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison ... Treasury Bills — TreasuryDirect If you write to us and want a response, please put your address in your letter (not just on the envelope). Department of the Treasury Bureau of the Fiscal Service Attention: Auctions 3201 Pennsy Drive, Building E Landover, MD 20785 Call Us For general inquiries, please call us at 844-284-2676 (toll free) E-mail Us

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Covid-19 Economic Relief | U.S. Department of the Treasury Latest Programs and Updates Office of Recovery Programs Self-Service Resources The Office of Recovery Programs is providing self-resources to assist recipients of awards from its programs with questions about reporting, technical issues, eligible uses of funds, or other items. View a complete list of available self-service resources. American Rescue Plan Six Month In total, the Treasury ... TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Treasury yields shoot higher, led by 1-year bill rate at 3.98%, as traders sell off bonds Oct. 5, 2022 at 9:43 a.m. ET by MarketWatch Why rising Treasury yields are plaguing the stock... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

6 month treasury bill rate 2 days ago · According to US Treasury Department, the treasury bills rates on 3 rd September 2021 were as follows: Type Rate; 4 Week T-Bill: 0.04: 8 Week T-Bill: 0.07: 13 Week T-Bill: 0.05: ...After 52 weeks, the T bills matured.Upon. Indeed, according to the provisional timetable of the country's operation on CEMAC's money market, Cameroon will issue 5-year fungible treasury.

Interest Rate On Treasury Bills - InterestProTalk.com The FD InterestRates of most banks are around 6% while the treasurybillrate for 2018 is 6.40% for 91 days, 6.52% for 182 days and 6.65% for 364 days. While this is high, a company fixed deposit offers an even higher rate of returns. Bajaj Finance Fixed Deposit offers interestrates up to 7.75% p.a. Flexibility in withdrawing funds.

T-Bills: What are they? How do they work? Are treasury bills safe? Know ... T-bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91-day Treasury bill of Rs 100 (face value) may be issued at say Rs 98.20, that is, at a discount of say, Rs 1.80 and would be redeemed at the face value.

Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction.

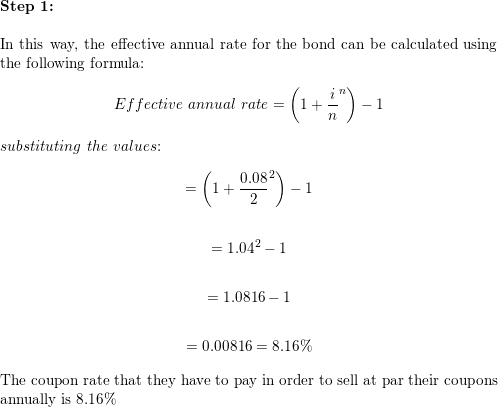

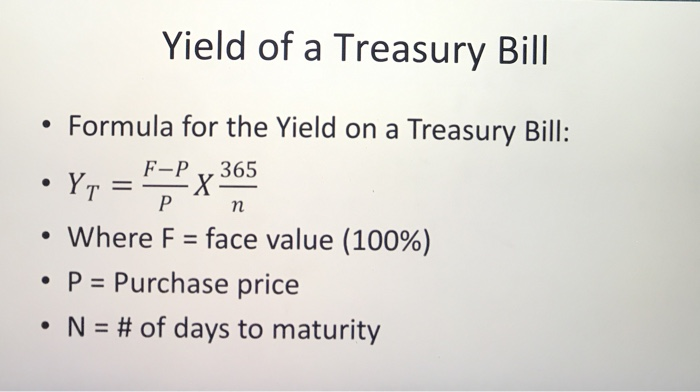

Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

10-Year U.S. Treasury Note: What It Is, Investment Advantages May 02, 2022 · In a recession, central banks tend to lower interest rates, which lowers the coupon rate on new Treasuries and, subsequently, makes older Treasury securities with higher coupon rates more desirable.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

What Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

How To Invest In Treasury Bills - Forbes Advisor Treasury Bills. T-bills have short maturities of four, eight, 13, 26 and 52 weeks. Since they offer such short maturities, T-Bills don't offer interest payment coupons.

What are coupons in treasury bills/bonds? - Quora Treasury bills do not have a coupon rate; they are sold at a discount and redeemed at face value, also known as par value. Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week.

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield …

What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

U.S. Department of the Treasury - Office of Foreign Assets Control The Office of Foreign Assets Control ("OFAC") of the US Department of the Treasury administers and enforces economic and trade sanctions based on US foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and …

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

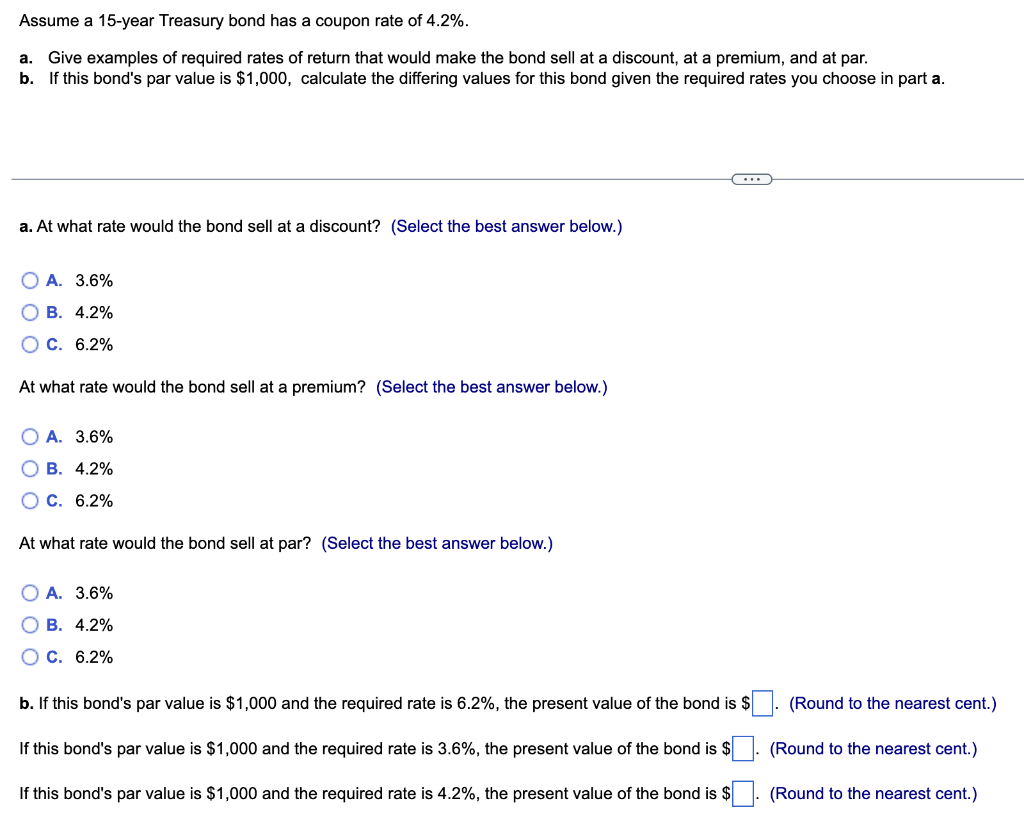

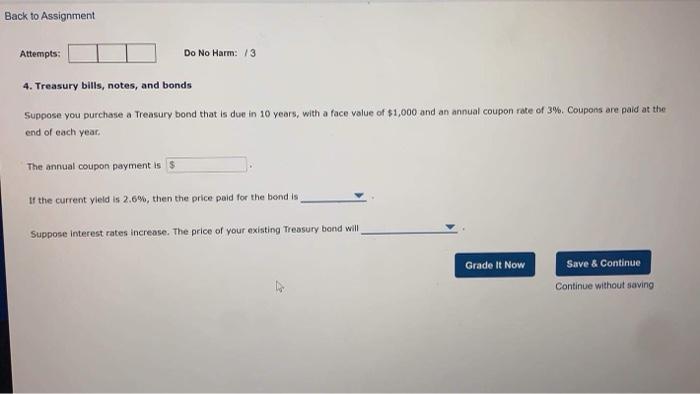

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to...

10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 4.17%, compared to 4.14% the previous market day and 1.53% last year.

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Post a Comment for "42 treasury bill coupon rate"